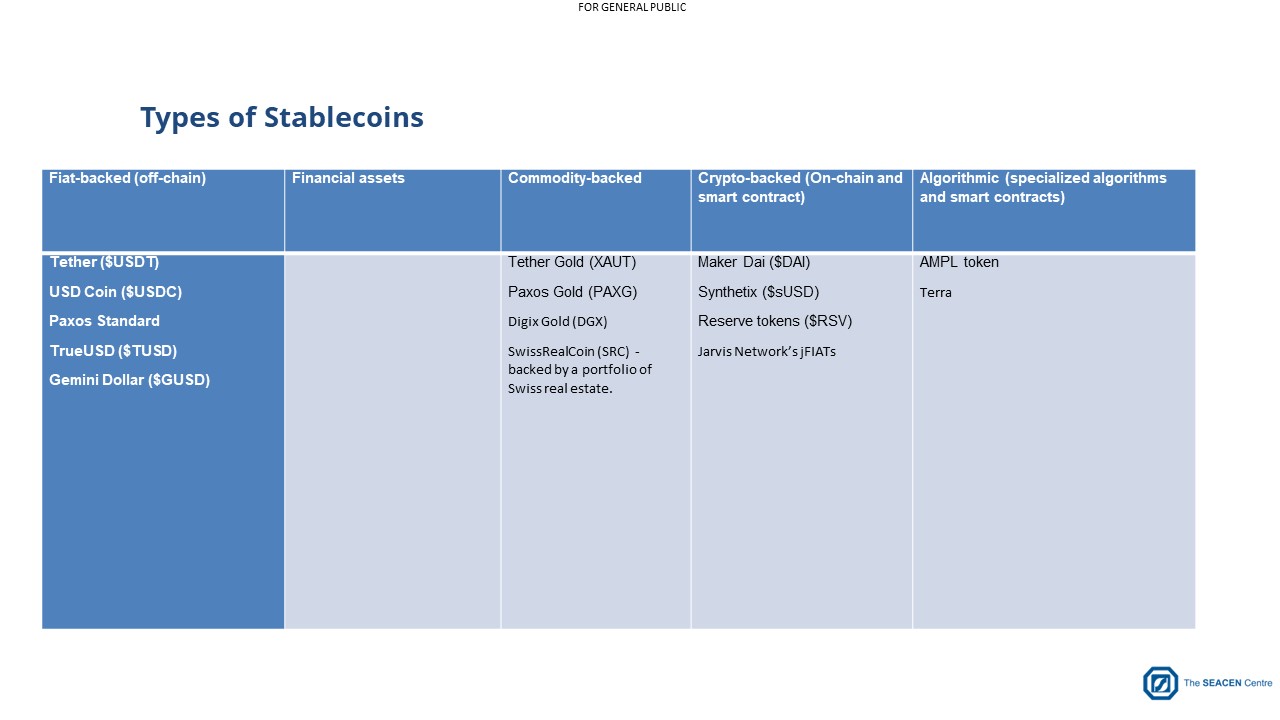

Stablecoins are a type of digital asset that purports to maintain a stable value by referencing physical, financial or virtual assets (FSB (2020)). They can be further differentiated into currency-based, financial instrument-based, commodity-based and crypto asset-based stablecoins. There are also algorithmic stablecoins that aim to maintain a stable value via protocols that provide for the increase or decrease of the supply of the stablecoins in response to changes in demand (FSB (2020)).

McKenzie (2022) acknowledged that risks associated with stablecoins go well beyond money laundering and terrorist financing (ML/TF) and fraud risks. In early May, the de-pegging of the TerraUSD (UST) stablecoin brought to the forefront the potential risks posed by stablecoins to global financial stability. According to Jon Cunliffe (2021), financial stability risks “currently are relatively limited but they could grow very rapidly if [crypto assets] continue to develop and expand at a rapid pace. How large those risks could grow will depend in no small part on the nature and on the speed of the response by regulatory and supervisory authorities.”

The purpose of this blog post is to look at the recent market meltdown in crypto assets, especially events relating to some stablecoins, market integration and contagion. We believe this is an important topic for SEACEN stakeholders in light of the recent market turmoil coupled with the International Monetary Fund (IMF) warning in its Global Financial Stability Report that a spike in cryptocurrency trading in emerging markets could imperil the global financial system. In recent years, crypto assets have gained in popularity in emerging market economies (EMEs), as illustrated in Aramonte et al. (2022, Box B). This development accelerated further after the COVID-19 crisis, especially in countries with volatile exchange rates.

In terms of activities in crypto assets, we know that they are largely executed outside the traditional financial sector, and as a consequence, regulators have a limited line of sight into who is holding these assets. The UK’s Financial Conduct Authority (FCA) estimates that there are a large number of retail investors in this space – 2.3 million adults own crypto assets in the UK alone. From a purely investor protection point of view, losses to retail investors may not be significant enough to trigger financial stability risk.

Direct exposure to banks and other financial institutions are unclear. But there is some evidence that institutional investors such as hedge funds are showing a growing interest in this emerging asset class. A good example of this would be the firm MicroStrategy which is mentioned further below in this post. In terms of the formal banking sector, there is little or no evidence of direct exposure to crypto. This does not mean, however, that the degree of interconnectedness between banks and crypto will not surge in the near future.

Long before the recent market de-pegging and dramatic collapse of TerraUSD, an algorithmic stablecoin, policymakers were worried about stablecoins. Late last year, Janet Yellen, US Secretary of the Treasury, noted that “Stablecoins that are well designed and subject to appropriate oversight have the potential to support beneficial payments options. But, the absence of appropriate oversight presents risks to users and the broader system. Current oversight is inconsistent and fragmented, with some stablecoins effectively falling outside the regulatory perimeter.”

Policymakers and regulators feared that a sudden loss of confidence in some of the largest global stablecoins (GSCs) could result in a “severe liquidity shock to the broader cryptocurrency market” (McKenzie (2022)). There are also concerns that a sudden increase of withdrawals from a systemically important stablecoin could lead to potential market contagion, affecting assets beyond crypto.[i] According to Eric Rosengren, former Boston Federal Reserve Bank President, “A future crisis could easily be triggered as these become a more important sector of the financial market, unless we start regulating them and making sure that there’s actually a lot more […] stability to what’s being marketed to the general public as a stablecoin.” Broadly, systemically important stablecoin activities should be subject to risk management policies, margin and collateral requirements, timing restraints, capital and financial resource requirements, and other digital asset-specific requirements suggested by the peculiarities of transacting in the digital space.

Fitch Ratings also warned that a sudden mass redemption of stablecoin tokens could destabilise short-term credit markets. More recently, the relatively nascent sub-industry has worried experts, including the Fed. Earlier this month, the US Fed expressed in its Financial Stability Report that there’s little clarity on what really backs stablecoins, and noted that a few big players dominate a market with little oversight. A loss of confidence, then, could trigger a devastating run, which could in turn tank confidence in the entire digital economy. And, in early May, Janet Yellen, testifying before the US Senate said “A stablecoin known as TerraUSD experienced a run and had declined in value. I think that simply illustrates that this is a rapidly growing product and that there are risks to financial stability.”

SEACEN Stakeholders

As was mentioned earlier, the implications of the recent market meltdown should be of interest to SEACEN stakeholders. We note for example that the Luna Foundation Guard and Terraform Labs — the company which created the Terra blockchain — are both registered in Singapore. TerraUSD also has strong ties to South Korea. Do Kwon, the founder of Terraform Labs is Korean. Since the crash, it is reported that a local investor in Singapore lodged a police report. In the report, the investor refers to UST as a “ponzi” scam and claims that it is not suitable for such an investment to be sold to retail investors who do not know any better. The investor also blames Singaporean influencers and so-called finance gurus for spreading misinformation about UST being a risk-free investment. Finally, he states that Do Kwon should be held accountable and refund investors the money which he made from Luna.

The Monetary Authority of Singapore (MAS) recognises three types of crypto assets — cryptocurrencies, utility tokens and security tokens — each with their own set of regulations. In particular, security tokens are strictly governed, adhering not only to anti-money-laundering and counter-terrorist-financing regulations, but the Securities and Futures Act as well. The authorities in Singapore have shown a commitment to support the growth of blockchain technology while at the same time cautioning against retail crypto trading. In March 2022, the governing body stated that it would review industry developments relating to stablecoins and assess its appropriate regulatory treatment accordingly.

In Singapore, crypto companies operating with a Major Payment Institution (MPI) license provide a glimpse into the regulatory approach to stablecoins. For example, StraitsX — the company which issues the XSGD stablecoin — is licensed for e-money issuance in Singapore. Under the terms of this license, the company is required to maintain a one-to-one backing between its stablecoin and the Singapore dollar. By mandating that assets advertised as stablecoins meet such requirements, regulators could help close the gap between the perceived and actual risk undertaken by investors.

In the case of South Korea, in 2017, the feverish trading in crypto led to the term “kimchi premium” — which refers to the extra value a leading cryptocurrency can fetch in the South Korean market, exceeding 20 per cent at one point.

The recent market meltdown may have a generational impact in South Korea. South Korea has become a hot bed of speculative investment in cryptocurrencies, accounting for 10 per cent of trades, according to industry estimates. People in their 20’s and 30’s do the lion’s share of trading. During the first quarter of 2021, 2.5 million new accounts opened on the four biggest cryptocurrency platforms in the country, according to Kwon Eun-hee, representative for the conservative opposition People Power Party. Out of that contingent, 33 per cent are in their 20’s while another 31 per cent are in their 30’s.

Among those who were supportive of crypto trading, 33 per cent cited a high rate of return as a reason for their interest. More worrisome, 15 per cent said cryptocurrencies serve as the “last chance of escape” from their current social status.

Eun Sung-soo, chairman of the Financial Services Commission, noted that cryptocurrencies “are not securities bound by the Capital Market Acts, but are instead virtual assets with no known substance. He pointedly refused to call people who purchase cryptocurrencies “investors” and noted that “the government has no duty to protect them.”

South Korean authorities have been clamping down on virtual currencies. Revised legislation requires crypto trading platforms to partner with banks to ensure they are trading under real names. Platforms that fail to comply will be forced to cease trades. These measures were put in place to prevent money laundering and other illicit acts, though it appears that the other unstated aim is to force smaller trading platforms to close up shop.

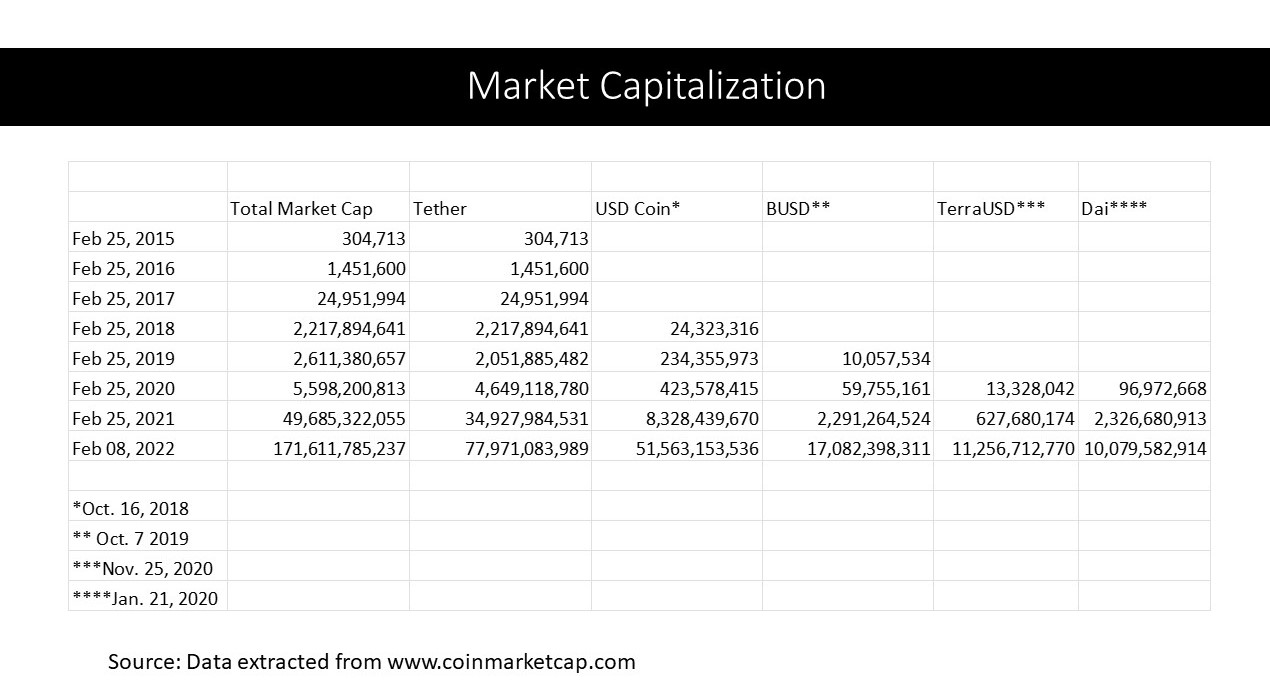

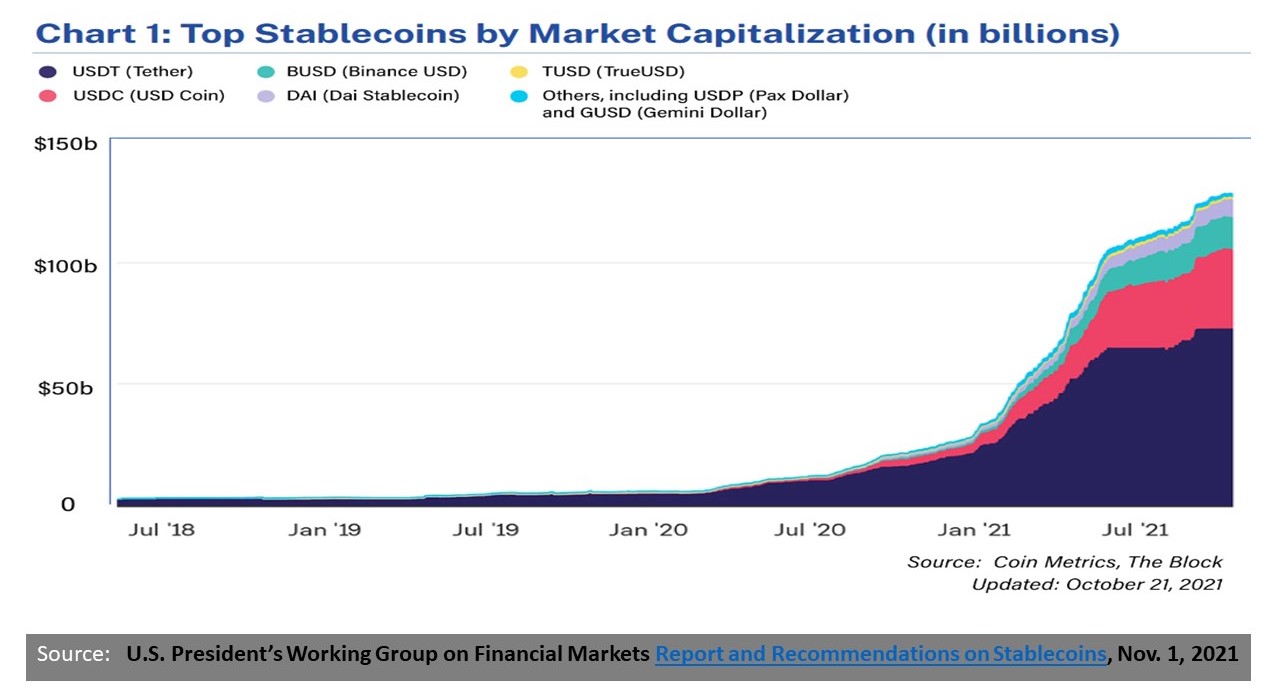

Phenomenal Growth

At the SEACEN Centre, we have been tracking the phenomenal growth of stablecoins, especially over the last two years (see charts below). According to Fitch Ratings, the ten largest stablecoins’ aggregate market capitalisation was USD160 billion at end-2021 (compared to USD28 billion at end-2020), a full-year growth rate of around 470 per cent. This meteoric boom propelled the rise of algorithmic stablecoins like TerraUSD. While algorithmic stablecoins are theoretically worth one US dollar per coin, they are not backed by physical assets such as gold or other commodities, or by a traditional financial instrument. They utilise sophisticated financial engineering[ii] to maintain their peg.

Source: US President’s Working Group on Financial Markets Report and Recommendations on Stablecoins, 1 November 2021

Stablecoins’ growth continued in 2022. Their total market capitalisation of USD187 billion as of 18 March 2022 represented an increase of 15 per cent since the beginning of the year. Tether remained the largest stablecoin by market capitalisation, reaching USD78 billion by end-2021, followed by USD Coin at USD42 billion. But beginning in mid-May, the market has been plummeting dramatically. The precipitous fall is due to the “cliffing” of the price of bitcoin which had plunged almost 50 per cent from its all-time high as traders — concerned about whether the Federal Reserve’s bid to fight inflation could tip the economy into a recession — dumped riskier investments. Also weighing on traders’ minds is the downfall of embattled stablecoin protocol TerraUSD which plummeted to less than 30 cents on Wednesday, 11 May, shaking investors’ confidence in the so-called decentralised finance (DeFi) space. The next day, a broader sell-off in cryptocurrencies erased more than USD200 billion from the entire market in a single day. TerraUSD traded at about 41 cents, still well below its intended USD1 peg. Luna, another Terra token that has a floating price and is meant to absorb UST price shocks, erased 99 per cent of its value and was, at the time of writing, worth just 4 cents.

According to a Bloomberg article, the collapse of one of TerraUSD coins has knocked more than USD83 billion off the total value of DeFi, as investors fled for safer havens. Several other stablecoins’ values have also started facing issues similar to TerraUSD. For example, recently Deus Finance’s DEI coin, an algorithmic coin, currently trading at around 66 cents, has been fluctuating, reaching a low of around 52 cents early Monday, 16 May.

The destabilisation of DEI and other coins has also opened up a new attack on a DeFi protocol called Scream, which lets users borrow cryptocurrencies by posting other ones as collateral. According to The Block, Scream, a DeFi lending protocol on Fantom, has incurred USD35 million in bad debt after failing to adjust the price of two stablecoins that lost their US dollar peg. The two stablecoins in question are Fantom USD (fUSD) and Dei (DEI). Both coins still have a quoted price of USD1, according to data from Scream’s dashboard. Yet they are trading well below peg. fUSD fell to as low as USD0.69 while DEI fell to USD0.52 at its lowest. Consequently, attackers were able to buy DEI coins for less than USD1 and post them as a full dollar’s worth of collateral. The result has left many Scream users unable to withdraw their deposits.

Market Contagion

Contagion in financial markets refers to the notion that markets move more closely together during periods of crisis. While financial integration helps to diversify risk, it may also increase the transmission risk during period of distress or crises. Financial integration leads to a significant increase in global leverage and can dramatically increase the degree of ‘contagion’ across markets. Contagion can impact an economic actor’s ability to finance itself and pay its debts. For example, contagion in the banking sector can precipitate a loss of capital or funding, and in the equity market it may indicate an increased risk aversion by investors and less availability of funding for listed companies.

With respect to the nascent and opaque crypto asset sector, what does contagion look like? There is not much data to go by. As noted above, direct exposure to banks and other financial institutions are unclear. As noted by Jon Cunliffe (2021), direct exposures provide an immediate channel by which losses could be transmitted from crypto assets to the existing financial sector. But there are also potential second round or indirect effects which can spread the impact into other asset classes. For example, a severe fall in the value of crypto assets could trigger margin calls on crypto positions forcing leveraged investors to find cash to meet them, leading to the sale of other assets and generating spillovers to other markets. In other words, a sudden surge in the demand for cash during periods of distress can put pressure on the amount of liquidity in the system.

The question is whether contagion is possible? It is not farfetched. A massive collapse in crypto asset prices, similar to what we have seen in tech stocks and the sub-prime market in 2008, is certainly a plausible scenario. In such a price correction scenario, the first question that arises is the degree of interconnectedness between crypto and the conventional financial sector.

Crypto and banks are not remote from each other even though the degree of interconnectedness is unclear at this time. Interconnectedness creates the possibility that shocks are transmitted through the financial system. Depending on propinquity, it is reasonable to say that a large fall in crypto valuations could affect investor risk sentiment more broadly, causing investors to sell other assets that are judged to be risky and those perceived to have a similar investor base. It would also depend on the degree of leverage which would have an amplification effect.

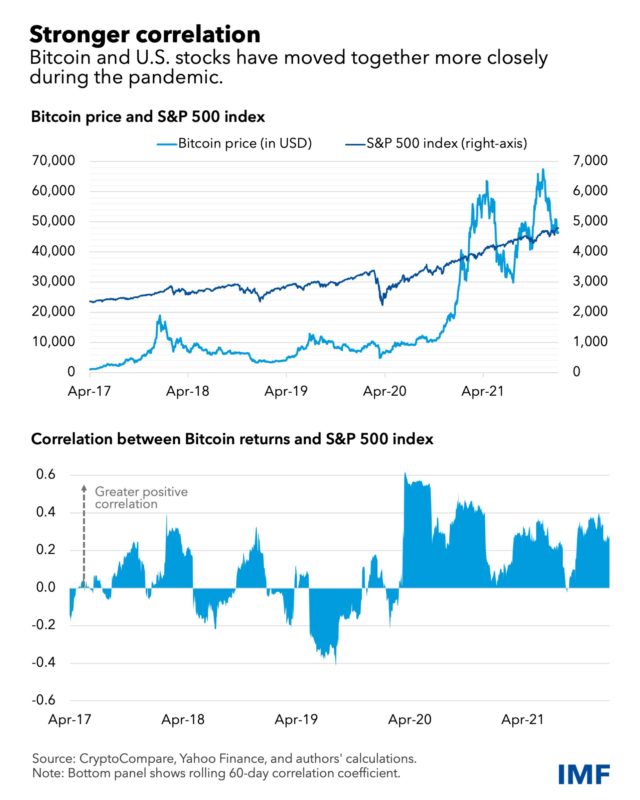

According to the IMF’s 2022 blog on “Crypto Prices Move More in Sync With Stocks, Posing New Risks,” the correlation between cryptocurrency assets and traditional assets such as stocks increased significantly and raised the risk of contagion across financial markets. The authors found that before the pandemic, crypto assets such as Bitcoin and Ether showed little correlation with major stock indices. They were thought to help diversify risk and act as a hedge against swings in other asset classes. But this changed after the extraordinary responses from central bank with regard to the COVID-19 crisis of early-2020. Crypto prices and US stocks both surged amid easy global financial conditions and greater investor risk appetite.

For instance, returns on Bitcoin did not move in a particular direction with the S&P 500, the benchmark stock index for the United States, in 2017–19. The correlation coefficient of their daily moves was just 0.01, but that measure jumped to 0.36 over 2020–21 as the assets moved more in lockstep, rising together or falling together. Stronger correlations suggest that Bitcoin has been acting as a risky asset.

Interestingly, in the case of emerging market economies, the authors found that the association between crypto and equities was apparently stronger. For example, correlation between returns on the MSCI emerging markets index and Bitcoin was 0.34 in 2020–21, a 17-fold increase from the preceding years.

Cryptocurrency assets are no longer on the fringe of the financial system. Given their high volatility, their increased co-movement with stocks could soon pose risks to financial stability, especially in countries with widespread cryptocurrency adoption. The IMF in its 2021 blog post on ”Crypto Boom Poses New Challenges to Financial Stability” noted that although the extent of the adoption of crypto assets is difficult to measure, surveys and other measures suggest that emerging market and developing economies may be leading the way. Most notably, residents in these countries increased their trading volumes in crypto exchanges sharply in 2021.

Interestingly, on Wednesday, 4 May, the US’s Federal Reserve raised its benchmark interest rate by half a percentage point, its most aggressive step to date in its fight against a 40-year high in inflation. Since then, credit markets have wobbled under the pressure of a shift to higher benchmark interest rates. In this context, there is the possibility (according to Katie Martin of the Financial Times) that Tether, one of the largest stablecoins, could, if push came to shove, offload chunks of its claimed USD24 billion stash of commercial paper, USD35 billion hoard of US Treasury bills, and/or its USD4 billion pile of “corporate bonds, funds and precious metals” into these market conditions – a reaction that is potentially unhelpful to financial stability, to say the least.

In fact, the IMF’s Blog noted that given the composition of their reserves, some stablecoins could be subject to runs, with knock-on effects to the financial system. The runs could be driven by investor concerns about the quality of their reserves or the speed at which reserves can be liquidated to meet potential redemptions. First, there is a liquidity mismatch between these backing assets and the redemption profile needed to serve as a payment instrument and, second, stablecoin operators may face difficulties in selling the backing assets, particularly in stressed conditions. These backing structures closely resemble those used by money market funds (MMFs). And we have also seen that in periods of stress MMF type structures can generate additional financial stability concerns by putting pressure on system-wide liquidity.

This scenario is not unthinkable. On Thursday, 12 May, the price of Tether’s USDT slipped as low as 94.55 US cents from its intended one-to-one peg to the US dollar before recovering to just above 98 US cents, Bloomberg-compiled data show. Paolo Ardoino, Tether’s chief technology officer, said in a tweet that investors can continue to redeem the tokens at a one-to-one value to the US dollar via its platform. With a market value of about USD84 billion, Tether is an essential cog to the array of crypto trades being carried out across the market at any given time. Investors turn to stablecoins as a way of retaining value without leaving the digital asset ecosystem, acting as a safe haven from volatile coins or even simply as a means of digital payment.

Tether is a critical bridge or infrastructure in the crypto, and according to the Financial Times, a deeper failure in the tether peg would likely be catastrophic for the wider crypto market, as some estimates suggest as much as 70 per cent of bitcoin purchases are made using this blockchain-native dollar alternative. According to Ingo Fiedler from Concordia University in Montreal, “If Tether would stop redeeming one tether for one dollar — that is, the peg breaks — this would have a huge impact on all markets traded against tether.”

Michael Saylor, a Bitcoin whale through his software company, MicroStrategy, has borrowed heavily to finance his buy-and-hold Bitcoin strategy. Lately that included the first-ever Bitcoin-backed term loan for USD205 million from Silvergate Bank, repayable over the next three years. MicroStrategy has set aside 19,466 Bitcoin to meet the minimum requirement of USD410 million security. With leverage comes the risk of margin calls. In May, Phong Le, MicroStrategy’s chief financial officer, indicated that it might be forced to post further collateral if the price of Bitcoin drops below USD21,000.

In April, Fidelity Investments announced it would offer Bitcoin as an investment option in its 401(k) plans by the middle of this year. This is a significant development, given that Fidelity is the largest 401(k) plan provider in the United States, acting as custodian for 23,000 plans, which have 20.4 million participants. In total, those plans represent USD2.7 trillion in assets under management. It is also the first major 401(k) provider to offer cryptocurrency as an investment for retirement savers.

Conclusion

The events surrounding TerraUSD in early May confirm policymakers’ concerns and worst fears about stablecoins. The increased and sizeable co-movement and spillovers between crypto and other markets indicate a growing interconnectedness between different asset classes that permits the transmission of shocks that can destabilise financial markets (IMF (2022)).

We cannot ignore crypto assets including stablecoins; they are no longer operating on the fringe of the financial system. Given their relatively high volatility and valuations, their increased co-movement could soon pose risks to financial stability especially in countries with widespread crypto adoption. It is thus time to adopt a comprehensive, coordinated global regulatory framework to guide national regulation and supervision and mitigate the financial stability risks stemming from the crypto ecosystem.

We note that the recent market meltdown should be interest to SEACEN’s stakeholders. We note TerraUSD has close ties with both Singapore and South Korean. The Luna/UST crash will be pivotal in the future of crypto adoption and regulation. Regulation will be critical to rebuilding trust among crypto investors following the market downturn.

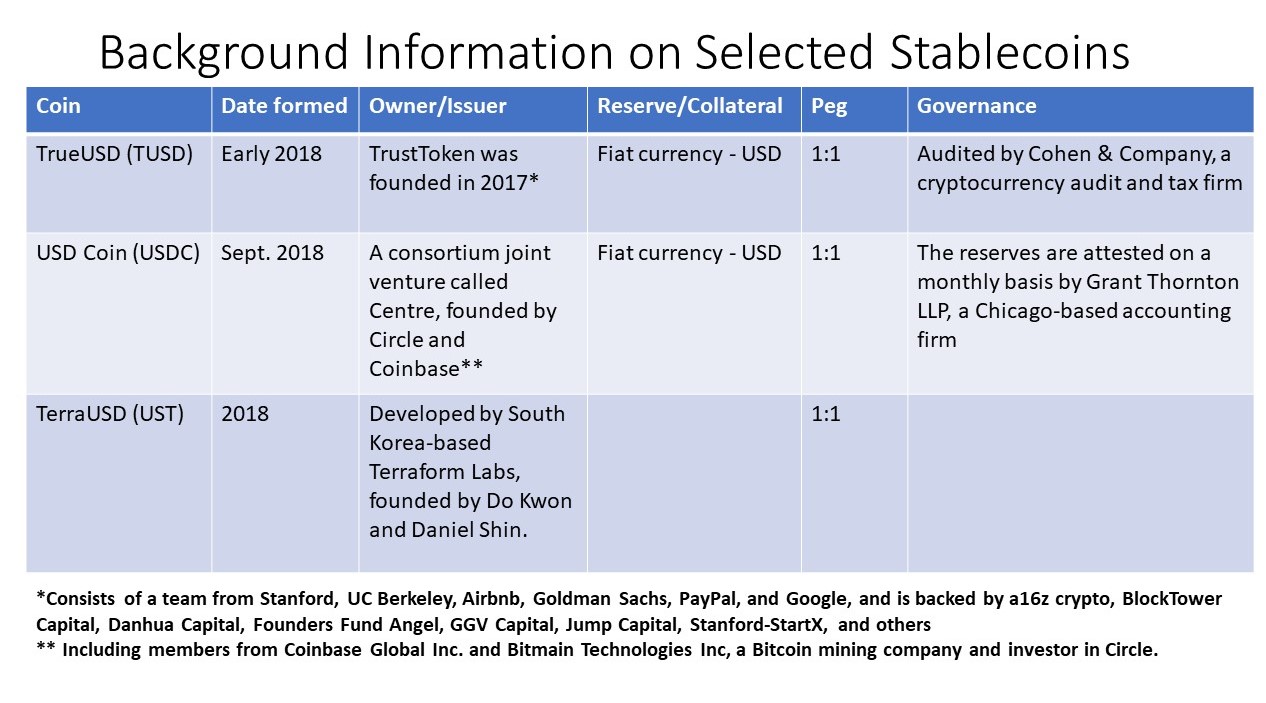

Annex: Background information on selected stablecoins

[i] The President’s Working Group on Financial Markets Report (the “Report”) on the future of stablecoins noted, among other things, that certain activities conducted within a “stablecoin” arrangement may constitute “systemically important payment, clearing, and settlement activities.” This would essentially declare stablecoin issuers as “systemically important financial institutions” (“SIFIs”) under Dodd-Frank—think of this as institutions that are “too big to fail.” Consequently, they should be subject to scrutiny of the extent of the leverage, exposure, interconnectedness with other SIFIs, importance as a source of credit for underserved communities, ownership, and any other risk-related factors deemed appropriate. The European Commission’s proposed regulation on markets in crypto-assets (“MiCA”) also contained a definition of a “significant stablecoin” which is similarly defined to SIFIs under Dodd-Frank: size, value, number of transactions, issuer’s reserve of assets, and instruments interconnectedness in the financial system.

[ii] Financial engineering is the use of mathematical techniques to solve financial problems. Financial engineering uses tools and knowledge from the fields of computer science, statistics, economics and applied mathematics to address current financial issues as well as to devise new and innovative financial products.

Mark is a Senior Financial Sector Specialist in the Financial Stability, Supervision and Payments pillar at the SEACEN Centre.