This post is an update of our blog Coronavirus and the Global Economy: Central Banks’ Policy Responses published on 5 March 2020, chronicling central banks and policymakers’ responses to COVID-19. We note that the COVID-19 outbreak has generated both demand and supply shocks reverberating across the global economy. Among major economies outside of China, the OECD forecasts the largest downward growth revisions in countries deeply interconnected with China, especially South Korea, Australia and Japan. Major European economies will experience dislocations as the virus spreads and countries adopt restrictive responses that curb manufacturing activity at regional hubs, including in Northern Italy.

The coronavirus (COVID-19) outbreak could cause global foreign direct investment (FDI) to shrink by 5%-15%, according to an UNCTAD report published on 8 March. The UN trade body had earlier projected a stable level of global FDI inflows in 2020-2021 with a potential increase of 5%. Now it warns that flows may hit their lowest levels since the 2008-2009 financial crisis, should the epidemic continue throughout the year. COVID-19’s negative impact on investment will be felt the strongest in the automotive, airlines and energy industries, the report says.

According to the Center for Strategic and International Studies (CSIS), at the sectoral level, tourism and travel-related industries will be among the hardest hit as authorities encourage “social distancing” and consumers stay indoors. The International Air Transport Association warns that COVID-19 could cost global air carriers between $63 billion and $113 billion in revenue in 2020, and the international film market could lose over $5 billion in lower box office sales. Similarly, shares of major hotel companies have plummeted in the last few weeks, and entertainment giants like Disney expect a significant blow to revenues. Restaurants, sporting events and other services will also face significant disruption. Industries less reliant on high social interaction, such as agriculture, will be comparatively less vulnerable but will still face challenges as demand wavers.

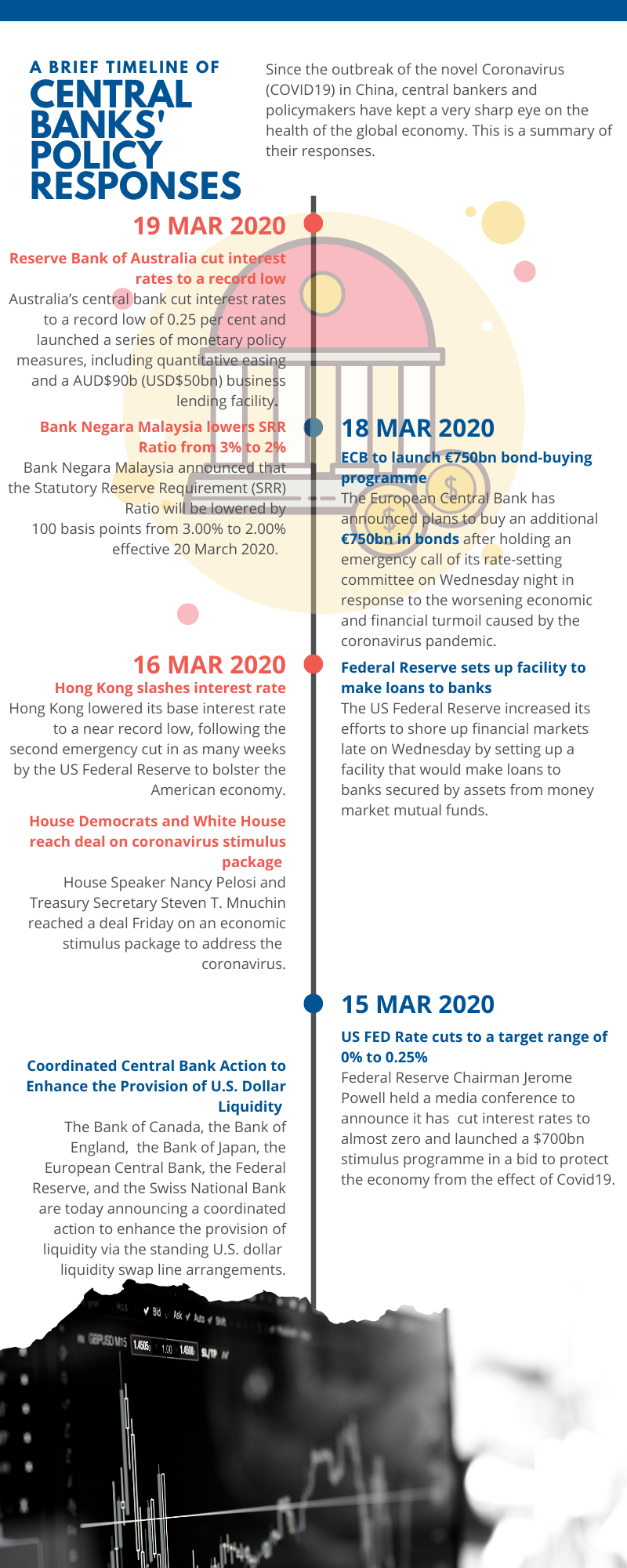

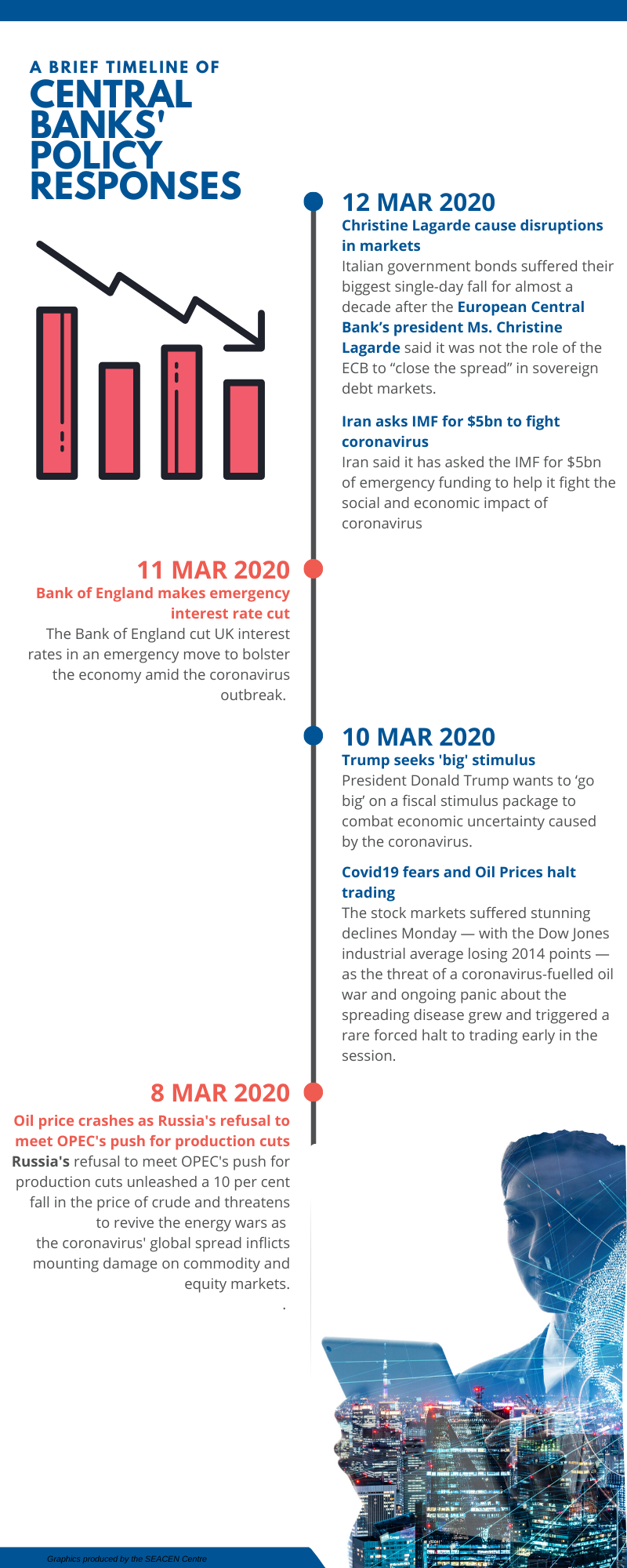

Since our blog post on 5 March 2020, we noted that central banks, governments and international agencies such as the International Monetary Fund (IMF) have taken a much more decisive and coordinated approach in their efforts to mitigate the impact of COVID-19 on the global economy. In response to this crisis, governments and central banks all over the world have enacted fiscal and monetary stimulus measures to counteract the disruption caused by the coronavirus. The IMF announced $50 billion of support for countries hit by the coronavirus. Since this announcement, Iran said it has asked the IMF for $5 billion of emergency funding to help it fight the social and economic impact of coronavirus.

The US announced another significant rate cut and are discussing an economic stimulus package. A number of other central banks such as the Bank of England and the Reserve Bank of Australia also cut interest rates. In addition, the Bank of Canada, the Bank of England, the Bank of Japan, the European Central Bank (ECB), the Federal Reserve and the Swiss National Bank are today announcing a coordinated action to enhance the provision of liquidity via the standing US dollar liquidity swap line arrangements. The ECB also announced a range of operational measures that it is taking as a precaution to protect its staff from risks associated with the spread of COVID-19.

Despite central bank and government actions, there has been a dislocation in financial markets and a crash in oil prices. Stock markets suffered significant declines as the threat of a coronavirus-fuelled oil war and ongoing panic about the spreading disease grew and triggered a rare automatic halt to trading early in the session. Russia’s refusal to meet OPEC’s push for production cuts unleashed a 10% fall in the price of crude oil and threatens to revive an energy war as the coronavirus’ global spread inflicts mounting damage on commodity and equity markets. Italian government bonds suffered their biggest one-day fall inalmost a decade after the ECB’s president, Ms. Christine Lagarde, said it was not the role of the ECB to “close the spread” in sovereign debt markets — referring to the spread between Italian and German bond yields that is a key risk indicator for Italy.

A question being asked is whether the IMF should inject liquidity through special drawing rights (SDRs) to alleviate the impact in most emerging and low-income countries, given that they are in a much weaker position compared with the global financial crisis of 2008-09. The fiscal space has all but disappeared. In 2007, 40 emerging market and middle-income countries had a combined central government fiscal surplus equal to 0.3% of gross domestic product (GDP), according to the IMF. Last year, they posted a fiscal deficit of 4.9% of GDP. The deterioration is not new — they have been posting deficits of this magnitude since 2015. The deficit of EMs in Asia went from 0.7% of GDP in 2007 to 5.8% in 2019; in Latin America, it rose from 1.2% of GDP to 4.9%; and European EMs went from a surplus of 1.9% of GDP to a deficit of 1%. Only in the Middle East has the situation barely changed, but countries there had large deficits in both periods, hardly a source of relief.

Consequently, the ability of EMs to implement countercyclical fiscal policies will be limited this time around. Their capacity for expansionary monetary policies is also significantly more constrained. For once, policy interest rates are already quite low in many EMs and their currencies are weakening fast against the US dollar. On top of this, the level of EM corporate hard currency debt is significantly higher now than in 2008. According to the IMF’s October 2019 Financial Stability Report, the median external debt of emerging market and middle-income countries increased from 100% of GDP in 2008 to 160% of GDP in 2019.

Mark is a Senior Financial Sector Specialist in the Financial Stability, Supervision and Payments pillar at the SEACEN Centre.