Since the outbreak of the novel coronavirus (Covid-19) in China, central bankers and policymakers have kept a very sharp eye on the health of the global economy. In some cases, Covid-19 has been compared to SARS in 2003, which some economists estimate cost the global economy $45 billion. At that time China only represented 8% of the world economy but since then China’s share of the world economy has grown to 19%.

In the past week or so, Covid-19 has become more threatening outside China as the virus is now rapidly spreading in countries such as Italy, South Korea, the US and Iran, just to name a few. Concurrently, in recent days, attention has turned to the likely damage to global output and to the possible reaction of macroeconomic policymakers.

Covid-19 is hitting the global economy when growth is soft, and inflation is relatively subdued, but many countries are grossly overleveraged. In case of the euro-area, for example, Covid-19 is hitting at a time when interest rates are already at a record low level of minus 0.5 per cent. Below we provide a chronicle of central banks and policymakers’ responses to Covid-19.

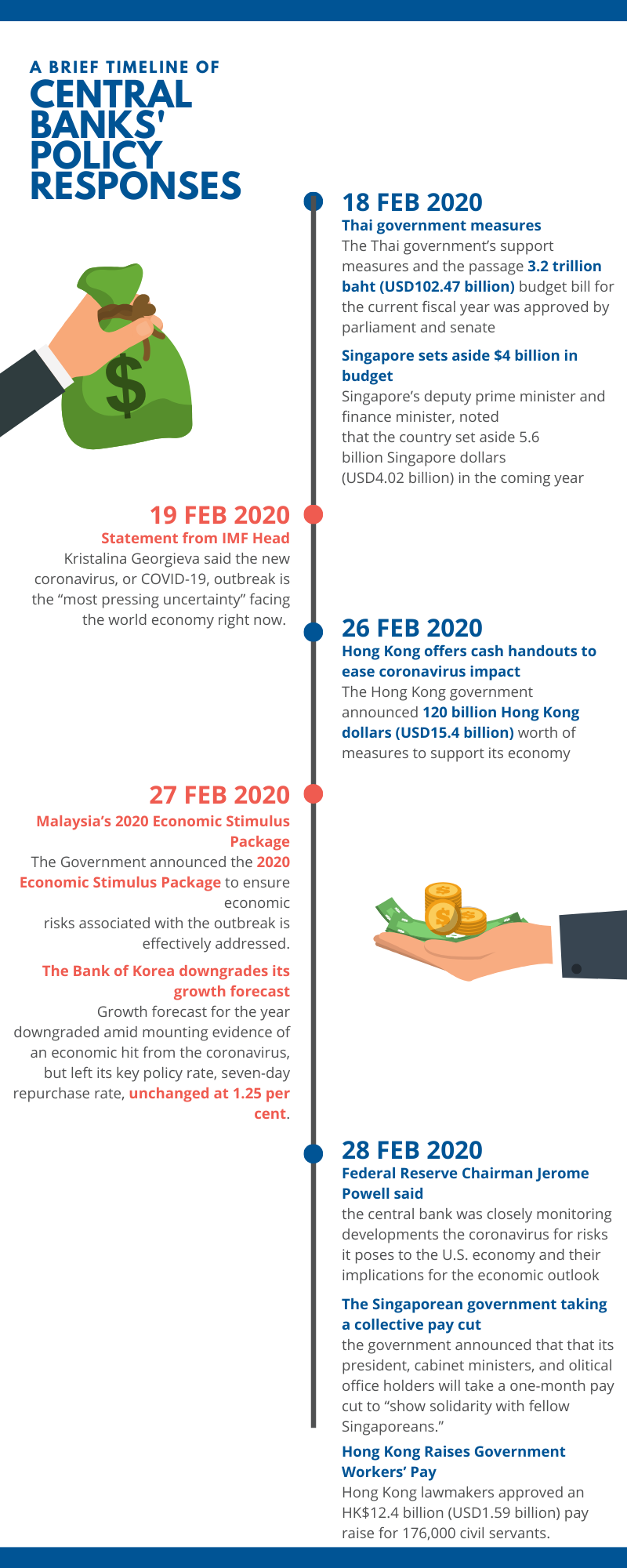

It appears the heightened attention that is being given to the likely impact of the virus on the global economy was kickstarted by a blog post by the International Monetary Fund’s (IMF’s) Managing Director, Kristalina Georgieva, on 19 February 2020 that was published on the IMF’s website. She noted that the new coronavirus, or COVID-19, outbreak was the “most pressing uncertainty” facing the world economy right now. She also highlighted that the international health emergency that “we did not anticipate in January” now threatened to derail global economic growth that was already under pressure from a global trade war and Brexit.

a few days later, speaking at the G20 summit in Saudi Arabia, the International Monetary Fund’s managing director also warned that the coronavirus had disrupted economic activity across the globe and called on countries to prepare for a weaker global growth outlook in the face of the virus. She noted her concerns that a quick recovery from the incident was not guaranteed. Even in the case of rapid containment of the virus, growth in China and the rest of the world would be impacted. She highlighted that we all hoped for a V-shaped rapid recovery but given the uncertainty, it would be prudent to prepare for more adverse scenarios.

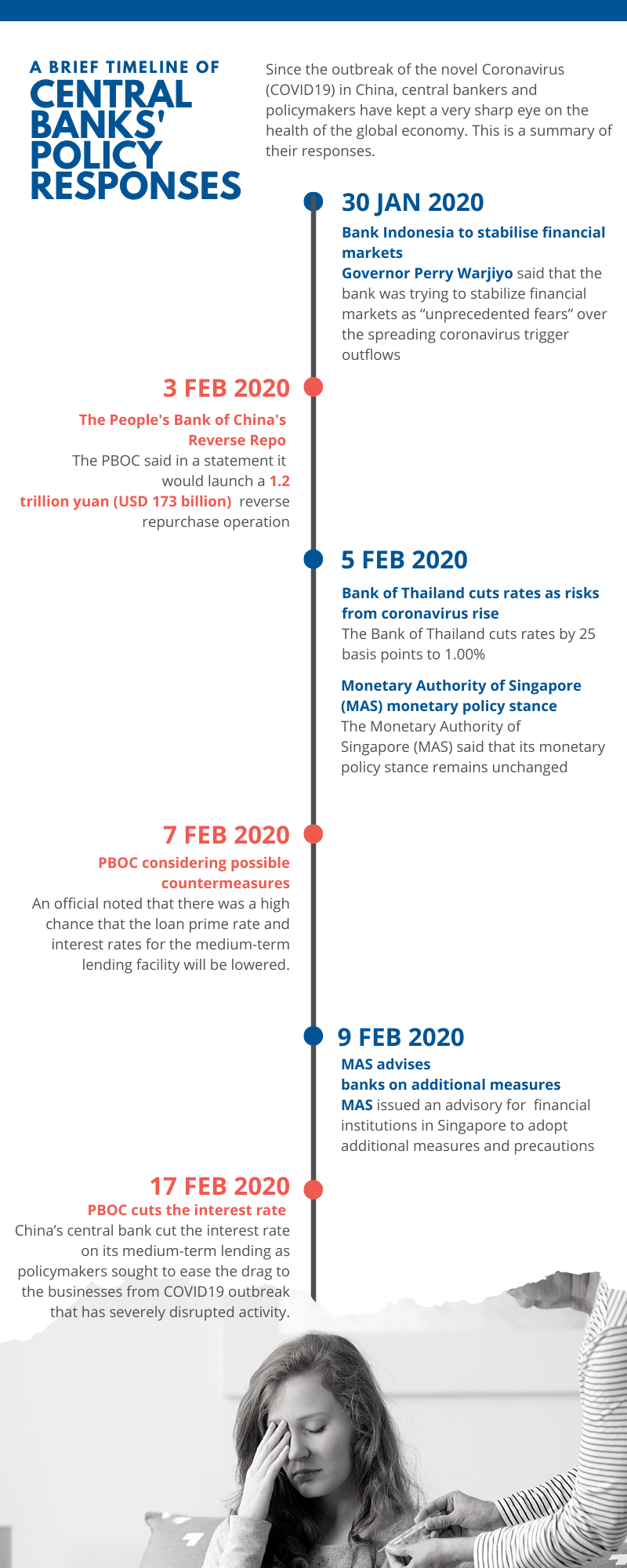

In our chronicling of central banks and policymakers’ responses to Covid-19 we noted that in the very early days (late January/early February) of the spread of the virus, Bank Indonesia, the People’s Bank of China and the Bank of Thailand were amongst the first central banks to verbalise policies and intervention actions to mitigate risks to their economies. At that time the spread of the virus was largely concentrated in China, the epicentre of the virus.

We also noted that since Friday, 28 February 2020, the official responses of macro policymakers in the advanced economies (AEs) have shifted from a seemingly nonchalant approach to a more aggressive and coordinated one. Since then, a number of central banks have cut interest rates including the US Federal Reserve, the Reserve Bank of Australia, the Bank of Canada and Bank Negara Malaysia.

We note the that while central banks around the world are easing monetary policy and governments are offering fiscal stimulus to limit the impact on economic activities, Covid-19 is not a conventional economic threat. As noted by Kenneth Rogoff, unlike the two previous global recessions this century, the new coronavirus, Covid-19, implies a supply shock as well as a demand shock. Supply shocks are slightly more challenging to manage by central bankers and policymakers than anxiety-induced frugality among consumers, firms and investors. On the one hand, when people stop spending, growth slows and inflation falls. On the other hand, when supply is constrained, as in the case of Covid-19, shutting down factories and disrupting global supply chains, prices can accelerate concurrently with rising unemployment.

Based on our chronicling of central banks and policymakers’ responses, we believe that the fiscal and economic stimulus that we have seen to buttress health systems and affected economic sectors such as travel, tourism and manufacturing are warranted. With global inflation relatively subdued, fiscal and economic stimulus can be pursued without exacerbating an ongoing inflation problem. Massive public sector spending, however, might be challenging for governments that have not saved for a rainy day or those that are already running massive deficits. On the monetary policy side, some central bank may be constrained by the fact that they lack room for monetary policy. This is particularly concerning for countries that are already at very low or even negative interest rates. In those cases, there may be concerns about the side-effects of negative interest rates and a fear that cutting them further may do little to address the impact of Covid-19 on the economy.

Mark is a Senior Financial Sector Specialist in the Financial Stability, Supervision and Payments pillar at the SEACEN Centre.