Background: Additional Tier 1 (AT1) Capital Instruments under Basel III

During the global financial crisis (2007-2009), several banks had to be rescued through capital injections by their governments which led to supporting not only the depositors but also the investors in Additional Tier 1 (AT1) and Tier 2 regulatory capital instruments. Inadequate loss-absorption by regulatory capital and the weaknesses of resolution frameworks left the authorities with no choice but to rescue banks with public funds, thereby socialising losses and worsening moral hazard. One of the key lessons of the global financial crisis was that investors in regulatory capital instruments should not be bailed out at the expense of taxpayers and this underlying objective is reflected in the design of the Basel III ‘definition of capital’.

Unlike Basel II, Basel III requires that elements of regulatory capital, such as AT1 and Tier 2 need to be loss-absorbing at the ‘Point of Non-Viability’ (PoNV): AT1 is required to absorb losses on a ‘going concern basis’ and Tier 2 capital on a ‘gone concern basis’. The loss-absorbing feature must be specifically mentioned in the terms of issue of the regulatory capital instrument, and it is expected that this feature will not only have pricing implications but will also provide an additional source of market discipline and reduce moral hazard. The holders of these instruments, who are sophisticated investors (and not retail investors), are more likely to assess or monitor the risk of bank failure at the time of making the investment and on an ongoing basis.

What do we mean by the Point of Non-Viability?

The Basel III framework introduces the concept of PoNV, which for the purposes of determining capital adequacy, establishes a close linkage between regulatory minimum capital standards and the supervisory assessments of capital adequacy, especially at the Point of Non-Viability. PoNV is the point at which a bank may no longer remain a ‘going concern’ on its own unless appropriate measures are taken for its revival. The PoNV assessment, although based on a variety of financial and non-financial indicators, is an exercise in supervisory judgement involving not only point-in-time assessments but also forward-looking assessments of bank’s viability.1The Reserve Bank of India characterises a non-viable bank as ‘A bank which, owing to its financial and other difficulties, may no longer remain a going concern on its own in the opinion of the Reserve Bank unless appropriate measures are taken to revive its operations and thus, enable it to continue as a going concern’. For example, the Office of the Superintendent of Financial Institutions (OSFI),2OSFI uses its supervisory judgement considering the following criteria to determine the Point of Non-Viability: (i) Whether the assets of the institution are sufficient to provide adequate protection to the institution’s depositors and creditors. (ii) Whether the institution has lost the confidence of depositors or other creditors and the public. This may be characterized by ongoing increased difficulty in obtaining or rolling over short-term funding. (iii) Whether the institution’s regulatory capital has, reached a level, or is eroding in a manner, that may detrimentally affect its depositors and creditors. (iv) Whether the institution failed to pay any liability that has become due and payable or the institution will not be able to pay its liabilities as they become due and payable. (v) Whether the institution failed to comply with an OSFI’s order to increase its capital. (vi) Whether any other state of affairs exists in respect of the institution that may be materially prejudicial to the interests of the institution’s depositors or creditors or the owners of any assets under the institution’s administration, including where proceedings under a law relating to bankruptcy or insolvency have been commenced in Canada or elsewhere in respect of the holding body corporate of the institution. the supervisory authority in Canada, determines PoNV by applying, inter alia, the solvency test (1. Whether the bank has sufficient assets to provide adequate protection to the bank’s depositors and creditors and 2. Whether the bank has failed to pay any liability that has become due and payable or the forward looking assessment of whether the bank will not be able to pay its liabilities as they become due and payable); the confidence test (as determined by the bank’s ability to obtain or roll over short-term funding); and the capital adequacy test (regulatory capital has, reached a level, or is eroding in a manner, that may detrimentally affect bank’s depositors and creditors).

To undertake the PoNV assessment, the authorities in the European Union (EU) determine whether a bank is ‘Failing or likely to Fail’ (FOLTF). In addition to the solvency test like the one carried out by OSFI, the FOLTF assessment by the EU authorities also involves determining whether requirements for ‘continuing authorisation’ are met on an ongoing basis as assessed, inter alia, through the Supervisory Review and Evaluation Process. The Pillar 2 assessment entails examination of the risk profile of the bank, its governance arrangements, its business model and strategy, and the adequacy of available own funds and liquidity resources. The FOLTF assessment is based on the discretionary assessment of the relevant authority 3EBA, EBA/GL/2015/07 dated 26 May 2015, Final report: Guidelines on the interpretation of the different circumstances when an institution shall be considered as failing or likely to fail under Article 32(6) of Directive 2014/59/EU..

Additional Tier 1 (AT1) Capital Instruments: Loss Absorption on a Going Concern Basis

As shown in Diagram 1, the PoNV condition in Basel III requires that AT1 capital instruments should be capable of absorbing losses on a going concern basis by either being converted into common equity or being written off. The trigger for conversion/write-off is the earlier of4Basel Committee on Banking Supervision, CAP, Definition of capital, document generated on 14/10/2023 based on the Basel Framework data available on the BIS website (www.bis.org).:

- a decision that a write-off, without which the firm would become non-viable, is necessary, as determined by the relevant authority; and

- the decision to make a public sector injection of capital, or equivalent support, without which the firm would have become non-viable, as determined by the relevant authority.

Diagram 1: Basel III framework: loss absorption by AT1 capital instruments

The loss absorption mechanism in Basel III operates through a pre-specified trigger point of at least 5.125 per cent Common Equity Tier 1 (CET1) for conversion/write-off of capital instruments classified as liabilities for accounting purposes. The loss absorption can take place either through the authority’s statutory powers or the contractual features of the capital instruments.

The Basel III framework5Basel Committee on Banking Supervision, ibid. (CAP, Definition of capital, Paragraph 12) stipulates that the aggregate amount to be written down/converted for all instruments classified as liabilities for accounting purposes on breaching the trigger level must be at least the amount needed to immediately return the bank’s Common Equity Tier 1 ratio to the trigger level or, if this is not possible, the full principal value of the instruments.

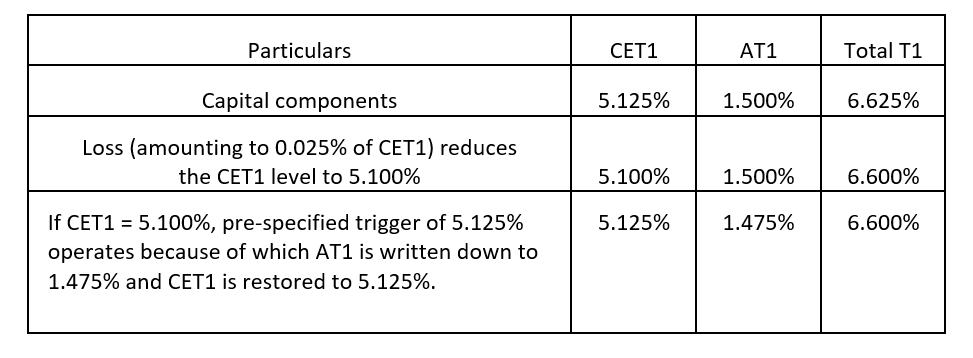

Let us illustrate this with an example. As shown in Table 1, there is a Basel III compliant bank with 5.125 per cent CET1, 1.500 per cent AT1 and 6.625 per cent Total Tier 1 (T1). The bank incurs a loss amounting to 0.025 per cent of CET1 because of which the CET1 falls to 5.100 per cent. At this point, the pre-specified Basel III trigger (5.125 per cent) for write down of AT1 will apply (we assume that the option of conversion into equity is not available as the terms of issue of the AT1 Bonds specify only the write-down option. Incidentally, this was the case in Credit Suisse). As a result of the loss absorbency mechanism in Basel III, the AT1 Bonds are written off to absorb losses but the CET1 holders are not affected adversely. This shows that the creditor hierarchy to be followed in resolution (in a gone concern situation) might not be applicable if AT1 Bonds are to absorb losses on a going concern basis (outside of resolution). One supervisory authority6RBI Master Circular on Basel III Capital Regulations, RBI/2023-24/31 DOR.CAP.REC.15/21.06.201/2023-24 May 12, 2023. has clearly mentioned in its guidelines that ‘The pre-specified trigger for loss absorption through conversion / write-down of Additional Tier 1 instruments must be at least Common Equity Tier 1 capital of 6.125 per cent of RWAs (the pre-specified trigger is higher than the Basel III trigger of 5.125 per cent because of higher minimum capital requirements of 9 versus 8 per cent in Basel III). The write-down of any Common Equity Tier 1 capital shall not be required before a write-down of any Additional Tier 1 capital instrument (emphasis added)’.

Table 1: An Illustration of AT1 bonds absorbing losses to ensure bank’s viability

Credit Suisse: The Point of Non-Viability

The events leading to the acquisition of Credit Suisse by UBS on 19 March 2023 are well documented7The Financial Stability Report, 2023, by The Swiss National Bank, gives a chronology of events that led to the acquisition of Credit Suisse by UBS.. The poor risk culture and governance at Credit Suisse led to repeated instances of risk management failures. Credit Suisse reported losses over several quarters and was viewed critically by its clients, market participants and rating agencies.

On Friday, 10 March 2023, a run on Silicon Valley Bank led to its collapse. This was the second largest bank failure in US history. The US bank failures and market stress were the immediate triggers for Credit Suisse’s downfall. On 15 March, Saudi National Bank, a major shareholder, ruled out further capital injections and Credit Suisse’s share price fell by more than 30 per cent. The Swiss National Bank (SNB) and the Swiss Financial Market Supervisory Authority (FINMA) issued a joint statement on market uncertainty. It was announced that liquidity will be provided, if required, and that Credit Suisse remained compliant with all regulatory capital and liquidity requirements (as of 15 March 2023).

On 16 March, the SNB provided CHF38 billion in liquidity under emergency liquidity assistance (ELA) and CHF10 billion under its liquidity-shortage financing facility (LSFF). But the CDS premia and share price of Credit Suisse weakened again reflecting high uncertainty about the bank’s future. Credit Suisse was experiencing a crisis of confidence and considerable outflows of client funds were taking place. On 17 March, the SNB provided additional emergency liquidity assistance (ELA+) of CHF20 billion. On Sunday, 19 March, Swiss authorities announced the acquisition of Credit Suisse by UBS. As per FINMA, there was a risk of the bank becoming illiquid, even if it remained solvent, and it was necessary for the authorities to take action8FINMA Press release dated 19 March 2023, FINMA approves merger of UBS and Credit Suisse.

On 23 March 2023, FINMA issued a press release9FINMA Press release dated 23 March 2023, FINMA provides information about the basis for writing down AT1 capital instruments. explaining the basis for writing down the AT1 capital instruments issued by Credit Suisse. There were two sets of AT1 instruments that Credit Suisse had issued, one with a high-trigger of 7 per cent CET1 ratio, and another with a low-trigger of 5.125 per cent CET1 ratio. While these triggers were not breached, the terms of issue of the AT1 instruments included an additional clause that they will be completely written down in a ‘Viability Event’. The extraordinary government support (i.e., grant of extraordinary liquidity secured by Federal default guarantee on 19 March 2023) constituted such a viability event. The Authorities ordered a complete write-down of the nominal value of all AT1 debt of Credit Suisse amounting to around CHF16 billion. On the other hand, all shareholders of Credit Suisse will receive 1 share in UBS for 22.48 shares in Credit Suisse10Media release by Credit Suisse dated 19 March 2023, Ad hoc announcement pursuant to Art. 53 LR, Credit Suisse and UBS to Merge.. The investors, markets and commentators were critical of this arrangement, where the AT1 bondholders were totally wiped off whereas the shareholders received some value, thereby reversing the hierarchy of claims in resolution or liquidation.

The author is of the view that the Swiss Authorities took a supervisory action11The FSB publication observes that, ‘Since the actions (by FINMA) were taken outside resolution, the absorption of losses by shareholders and bondholders did not follow the hierarchy of claims that is established for liquidation or resolution’ and not a resolution action12In his speech, Klaas Knot observes that ‘FINMA, the Swiss supervisor, used a supervisory, and not a resolution power, to enable this sale – and it came with a write-down of Credit Suisse’s AT1 securities. Although the possibility of such a principal write-down was included in the relevant AT1 prospectuses and mentioned on the bank’s Investor Relations page, although investors were clearly informed that extraordinary public support could lead to such a write-down, and that AT1 holders may suffer losses before equity holders, and although the coupons paid on the AT1-security well exceeded the RoE-target Credit Suisse had communicated to its investors, FINMA’s decision still took investors by surprise. This should encourage regulators to reflect on the role and functioning of AT1 instruments in determining the capital position of banks’.. To mitigate a bank’s probability of failure, the Supervisory Authorities implement prudential rules on capital, liquidity and governance and implement early intervention measures (including under Pillar 2). If a bank experiences more stresses and recovery plan triggers are breached, it needs to implement recovery plans already agreed with the supervisor. If a bank reaches the PoNV, in order to restore its viability, the Supervisory Authorities might consider write-off or conversion of AT1 bonds, as envisaged in Basel III.

The Report of the Expert Group13The Expert Group was constituted by the Swiss Federal Department of Finance. The report focuses on financial market and stability issues and makes recommendations which are intended to serve as a contribution to the evaluation and further development of the too-big-to-fail regime, and to support the Parliamentary Investigation Committee., constituted by the Swiss Federal Department of Finance, observes that if ongoing supervision tools are not sufficient to steer a bank out of a crisis, FINMA may, subject to certain conditions, implement ‘protective measures’, such as issuing instructions to a bank’s management, dismiss senior management, change the auditors and limit a bank’s operations. But the protective measures can be imposed only in the event of a bank’s impending insolvency, i.e., when the PoNV has been reached. The report also observes that FINMA has a great deal of leeway when determining the PoNV. It is sufficient for FINMA to have a ‘justified concern’ about ‘serious liquidity problems’. FINMA also has administrative discretion concerning the timeframe within which it should assess the situation.

Although FINMA imposed large fines and took a number of supervisory enforcement actions against Credit Suisse, the problems at Credit Suisse continued to persist. Credit Suisse complied with the Basel III capital adequacy norms but faced a crisis of confidence as reflected in its strained liquidity14In 2017, the ECB in its publication of non-confidential ‘Failing or Likely to Fail’ assessments of Banco Popular Español S.A., stated that ‘…. Given the above, particularly the excessive deposit outflows, the speed at which liquidity is being lost from the bank and the inability of the bank to generate further liquidity, there are objective elements indicating that the Supervised Entity is likely in the near future to be unable to pay its debts or other liabilities as they fall due. Therefore, the Supervised Entity is deemed to be failing, or in any case likely to fail in the near future…’. The above observations in many ways also seem to echo the problems being faced by Credit Suisse., persistent low profits, repeated and highly damaging misconduct cases and very costly risk management failures15Bank of England, Bank failures − speech by Sam Woods, published on 16 October 2023.. As shown in Diagram 1, for Credit Suisse the conversion of AT1 bonds to equity was not an option because the terms of issuance of the AT1 bonds mentioned only the option of a write-down in case of a viability event. Also, the Basel III pre-specified trigger of 5.125 per cent CET1 was not applicable for Credit Suisse as the Swiss ‘Too Big to Fail’ regulations laid down the trigger at the quantitative threshold of 7 per cent CET116The Financial Stability Report, 2023, ibid..

By their very design, the AT1 bonds are required to absorb losses in a going concern situation.17The paper by Bolton et al. (2023) mentions that ‘Credit Suisse CoCos have precisely fulfilled their purpose: allowing for a swift and seamless recapitalisation, which facilitated the completion of the merger deal with UBS, and so limited Swiss taxpayers exposure to losses from Credit Suisse. In its decision FINMA also creates a healthy precedent: restoring financial discipline in AT1 bond markets by reminding investors that their investment bears the first brunt of credit risk and that due diligence is advised before investing in these products’. 18Inter alia, FSI Brief No 21, makes the following observations: (i) As demonstrated by the recent Credit Suisse episode, outside resolution, some Additional Tier 1 (AT1) bonds may be written down entirely before the wipe-out of Common Equity Tier 1 (CET1). This situation implies a transfer of value from holders of such AT1 bonds to shareholders. (ii) While the isolated write-down is feasible in many jurisdictions, unintended consequences associated with the use of this mechanism may lead authorities to only write down these bonds in resolution. This would effectively deprive them of their ability to absorb losses on a going-concern basis. (iii) Since the AT1 instruments were conceived for the purpose of absorbing losses on a going-concern basis, there may be merit in considering whether the current design of AT1 instruments remains fit for purpose or whether adjustments to the regulatory framework might be necessary. The Swiss Authorities exercised their supervisory judgement and ordered that the AT1 Bonds be written down before CET1 to restore Credit Suisse to viability, as envisaged under the Basel III framework. This decision was complemented by the state-assisted sale of Credit Suisse to UBS in order to prevent serious damage to the Swiss and international financial markets.

Footnotes

Amarendra is a Senior Financial Sector Specialist in the Financial Stability, Supervision and Payments pillar at the SEACEN Centre.