[1] The views expressed here are those of the authors, and do not necessarily represent those of the Banque de France or The SEACEN Centre.

Executive summary

The Basel Committee on Banking Supervision (Basel Committee or BCBS) addresses climate-related financial risks through the existing Basel Framework (a set of 14 standards covering all the areas of bank prudential regulation, supervision and disclosures). The BCBS considers that the climate risk drivers can be captured in traditional financial risk categories such as credit, market and operational risks.

In November 2023 the Basel Committee published a Consultative document on the disclosure of climate-related financial risks (henceforth Basel CRFR Disclosure Requirements). This document proposes certain bank-specific Pillar 3 disclosure requirements to complement the International Sustainability Standards Board (ISSB) framework, provides a common disclosure baseline for internationally active banks, and promotes the availability of accurate, consistent and high-quality climate-related data that will facilitate forward-looking risk assessments by banks. Based on the feedback received, the Basel Committee will decide the elements of disclosure which could be made mandatory or subject to national discretion. The development of a disclosure framework is likely to be an iterative process because the collection of climate-related data is in early stages and the methodologies for compiling climate-related data are still evolving.

The desktop survey is an attempt to assess the extent to which the banks are complying with the Basel Committee’s Consultative document on Pillar 3 disclosure requirements for climate-related financial risks. The objective is to identify the gaps and highlight the best practices so that the banks can further improve the content, coverage and quality of disclosures and the supervisory authorities can monitor the banks’ progress. The desktop survey is based on a limited sample size (14 Asian banks from ten Asian jurisdictions and six European banks from six European jurisdictions) and, therefore, it does not aim to be representative of the Asian or European banking sector. Only publicly available information has been used and the compliance assessments have not been discussed with the selected banks. This desktop survey is neither intended to be, nor is it based on, any supervisory exercise. It is acknowledged that the Pillar 3 disclosure requirements for climate-related financial risks might undergo some changes based on the feedback to the consultative paper and these requirements have not yet been implemented by jurisdictions.

The key findings of the desktop survey are the following:

First, all Asian banks in the sample are already disclosing some elements of climate-related financial risks. More work, however, needs to be undertaken by the banks and the supervisory authorities to ensure full compliance with the Basel CRFR Disclosure Requirements. It is observed that the banks use different templates/formats/reports (e.g., Annual Report, Sustainability Report, Task Force on Climate-Related Financial Disclosures (TCFD) Report, Environmental, Social and Governance (ESG) Framework Policy, etc.) as currently there is no uniform regulatory requirement for banks’ climate-related financial disclosures prescribed by jurisdictions. The content of banks’ disclosures is mostly business-oriented, i.e., focusing on opportunities, whereas the supervisory focus is more on climate-related financial risks.

Second, the Asian banks in the sample disclose qualitative information especially regarding their governance, and to a lesser extent, their strategy and risk management (Table CRFR-A of the Basel Disclosure Requirements). The qualitative disclosures (by the Asian and the European banks in the sample) relating to physical, transition and concentration risks, however, remain very patchy (Table CRFR-B of the Basel CRFR Disclosure Requirements).

Third, the Asian banks in the sample do not yet disclose the quantitative information relating to climate-related financial risks required under Basel CRFR Disclosure Requirements. This is possibly because the data collection on climate-related financial risks is still in its infancy, and there have been no regulatory CRFR Disclosure Requirements for banks so far. The quantitative Basel CRFR Disclosure Requirements (Templates CRFR-1 to CRFR-5) relate to the following areas: (i) transition risk – exposures and financed emissions by sector; real estate exposures in the mortgage portfolio by energy efficiency level; emission intensity per physical output and by sector; and facilitated emissions related to capital markets and financial advisory activities by sector; and (ii) physical risk – exposures subject to physical risks.

Fourth, it is observed that the content, coverage and quality of banks’ disclosures of climate-related financial risks also depends on each bank’s approach and commitment to climate-related disclosures. Banks in the same jurisdiction subject to the same regulatory framework have marked differences in the content, coverage and quality of their disclosures of climate-related financial risks. In the same vein, the asset size of the bank (Global Systemically Important Bank – G-SIB, or Domestic Systemically Important Bank – D-SIB) does not seem to have an impact on the bank’s compliance with Basel CRFR Disclosure Requirements.

As a whole, the Asian banks in the sample are assessed to be 25% compliant with Basel CRFR Disclosure Requirements (63% for the European banks), highlighting that although they are complying with certain elements of the disclosure requirements even without a mandatory national regulation in this field, more work is needed to ensure full compliance.

Approach and methodology

The desktop survey is based on publicly available climate-related financial disclosures of a sample of 14 Asian and six European banks.[1] Among those six European banks, five are in jurisdictions under the direct Single Supervisory Mechanism (SSM) supervision and for which a binding regulatory framework regarding climate-related financial disclosures is already implemented through CRSD (Corporate Reporting Sustainability Directive) and CRR (Capital Requirements Regulation).[2]

The selection of the banks in the sample is based on the following:

- ten Asian jurisdictions and six European jurisdictions have been selected based on their 2023 GDP; and

- the 14 Asian and six European banks from the above jurisdictions have been selected based on (i) their asset size (could be a G-SIB or D-SIB); (ii) their business model (banks with predominantly retail and corporate lines of business, but no investment banks); and (iii) their profitability.

It is acknowledged that the Asian or the European banks in the sample may not be representative of the entire Asian or European banking system, but the survey is an attempt to highlight some general trends that may be discernible looking at a small sample of banks.

The banks have been assessed on their compliance with each table/template of the Basel CRFR Disclosure Requirements, namely:

- qualitative information related to in terms of governance, strategy and risk management (CRFR-A);

- qualitative information relating to physical, transition and concentration risks (CRFR-B); and

- quantitative information relating to physical and transition risks (CRFR-1 to 5).

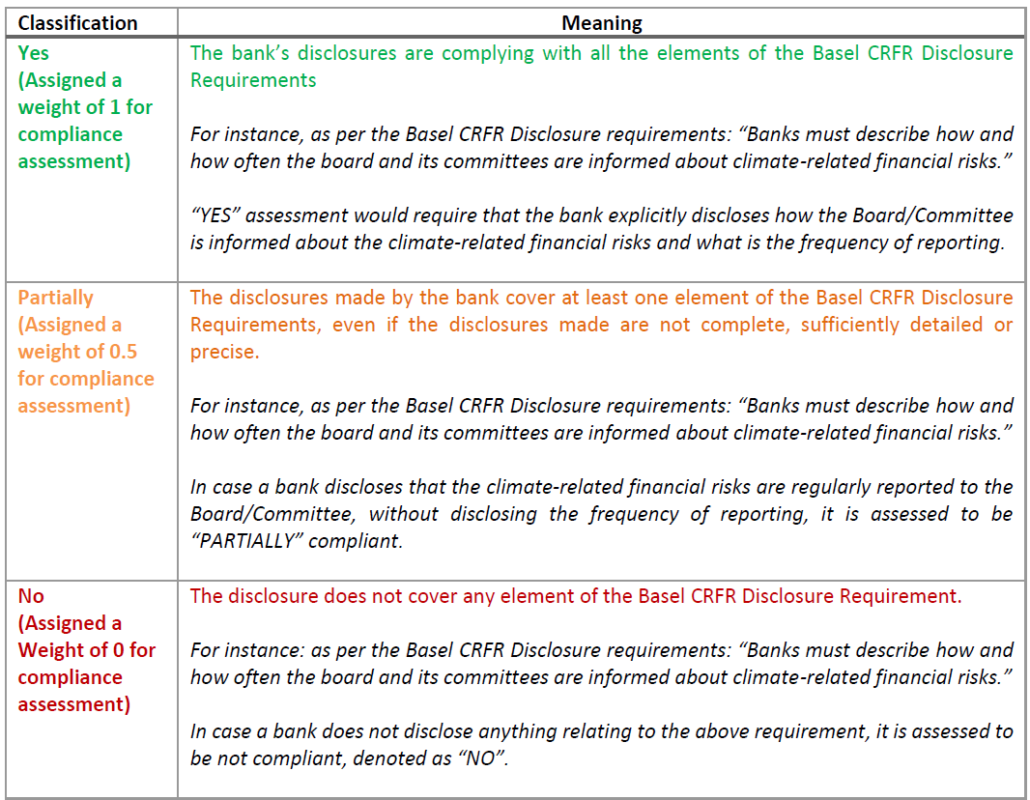

The level of compliance is assessed on the following scale: (i) ‘Yes’ – denoting full compliance (assigned a weight of 1 for an overall compliance assessment of, for example, governance component in Table CRFR-A: Qualitative information on climate-related financial risks), (ii) ‘Partially’ – denoting partial compliance (assigned a weight of 0.5 for an overall compliance assessment of, for example, governance component in Table CRFR-A: Qualitative information on climate-related financial risks), (iii) ‘No” – denoting non-compliance (assigned a weight of 0 for an overall compliance assessment of, for example, governance component in Table CRFR-A: Qualitative information on climate-related financial risks). The details are explained in Table 1 below.

Table 1: Assessing the level of compliance of a bank with the Basel CRFR Disclosure Requirements

Main findings

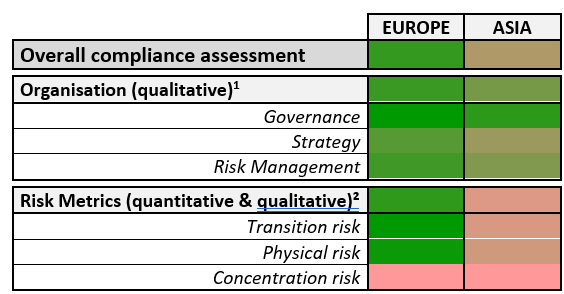

The heatmap (Figure 1) highlights the compliance assessment of European and Asian banks in the sample with the Basel CRFR Disclosure Requirements relating to climate-related financial risks. The heatmap shows that the European banks in the sample are compliant (dark green cells) or partially compliant (cells with lighter shades of green) with the qualitative requirements (governance, strategy and risk management) and quantitative risk metrics (transition risk and physical risk), but are not compliant (pink cell) with concentration risk disclosure metrics. The Asian banks in the sample, on the other hand, are in the early stages of compliance with the Basel CRFR Disclosure Requirements. They are compliant with the governance disclosures (dark green cell) but not so much with disclosures relating to strategy (a cell with a mixture of green and pink colours) and risk management (a light green cell). The Asian banks in the sample are not complying with the disclosures of risk metrics relating to quantitative and qualitative aspects of transition, physical and concentration risks. These findings could be explained by the fact that the European Union has already implemented a regulation for disclosures relating to ESG risks, whereas the surveyed Asian jurisdictions have not implemented bank regulation for mandatory disclosures relating to climate-related financial risks. Given this background, it is noteworthy that the Asian banks are complying with some of the elements of Basel CRFR Disclosure Requirements.

Figure 1: Heatmap of compliance assessment with Basel CRFR Disclosure Requirements

by the surveyed European and Asian banks

1CRFR-A; ²CRFR-B & CRFR-1 to 5

The key findings of the desktop survey are as follows:

First, the climate-related financial risk disclosures (of both European and Asian banks in the sample) are spread over several documents and reports published at different points in time. This makes it challenging to make a comprehensive assessment of the content and quality of these disclosures at a particular point in time.

Among the 20 banks in the sample, at least eight types of reports are used to make disclosures relating to climate-related financial risks: Annual Reports, Climate Reports, ESG Reports, Sustainability Reports, CRS Reports, Strategic Reports, TCFD Reports, Progress and Alignment Reports. The assessment made in the survey also considers disclosures made in the documents such as: policies and procedures (five banks, four of them Asian), internet pages (nine banks), Excel files containing the quantitative metrics or PDF data books (eight European banks). The disclosures made in transition plans of five banks (three European and two Asian banks) have also been considered for the assessment. The above documents/reports have different dates of issuance. The multiplicity of reports (containing some parts of climate-related financial risk disclosures) with different dates of issuance hinders a comprehensive assessment of the content and quality of disclosures at a particular point in time.

Second, 13 out of 14 Asian banks in the sample disclose their climate-related financial risks through a sustainability report which also includes social and governance elements, and the disclosures are generally more oriented towards the business opportunities rather than the risks that the banks face. The European banks clearly delineate climate-related financial risks from the social and governance aspects in their disclosures. Although the ISSB IFRS S1 and IFRS S2 (and the former TCFD) require disclosures relating to both opportunities and risks relating to climate risk, the Basel CRFR Disclosure Requirements focus only on the climate-related financial risks.

Third, the Asian banks in the sample show an overall compliance of 43% (European banks 54%) with the qualitative disclosure requirements for governance, strategy and risk management (Table CRFR-A).

The 43% overall compliance level could be because the majority (75%) of the Asian banks state that they follow the TCFD disclosure requirements, and both the ISSB and Basel Committee disclosure frameworks incorporate key elements of the TCFD approach.

Asian banks in the sample are assessed to be 65% compliant with the governance component of the qualitative disclosure requirements in Table CRFR-A. As show in Figure 2, Asian banks are fully compliant with 40% of the governance disclosure requirements and partially compliant with 50% of these requirements. (The compliance with the governance component is assessed at 65% because full compliance has a weight of 1 and partial compliance has a weight of 0.5 in the overall component score: (40*1) + (50*0.5) = 65%). The ‘partially compliant’ assessment is mainly due to inadequate disclosure on: (i) how the board and its committees consider climate-related financial risks when overseeing the bank’s strategy, its decisions on major transactions, and its risk management processes and related policies, including whether the board has considered trade-offs associated with those risks; and (ii) how the board oversees the setting of forecasts related to climate-related financial risks and monitors progress towards those forecasts.

Figure 2: Compliance with the Basel CRFR Disclosure Requirements’

qualitative disclosures in Table CRFR-A

The Asian banks in the sample are assessed to be 31% compliant (53% for the European banks) with the strategy component of the qualitative disclosure requirements in Table CRFR-A.[3] The strategy component has the highest level of non-compliance (48% for the Asian banks) within the qualitative disclosure requirements. This is mainly due to the Asian banks in the sample focusing more on disclosures of business opportunities rather than adequate disclosures on the strategy relating to climate-related financial risks. Also, very few Asian banks disclose prudential transition plans as these are not yet mandatory in most jurisdictions. There is inadequate disclosure of the current and anticipated effects of climate-related financial risks on the banks’ business model and value chain. None of the Asian banks in the sample has disclosed the effects of the climate-related financial risks on the banks’ financial position, resourcing, financial performance and cash-flows over the short-, medium- and long-term.

The Asian banks in the sample are assessed to be 39% compliant with the risk management component of the qualitative disclosure requirements in Table CRFR-A. They are partially compliant (46%) and fully compliant (16%) with the disclosure requirements relating to the risk management component. The banks do not make adequate disclosures on the following: monitoring of climate-related financial risks, description of scenarios used and prioritisation of climate-related financial risks relative to other types of risks.

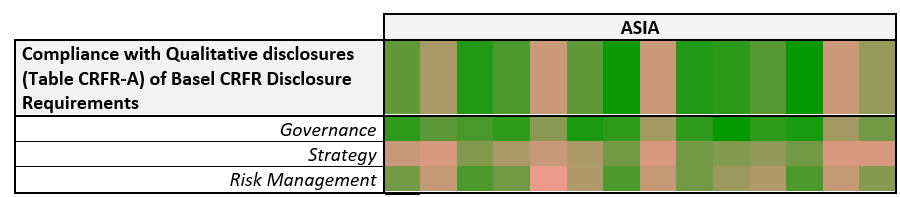

The qualitative disclosures on governance, strategy and risk management reveal a high degree of heterogeneity between the Asian banks in the sample (full compliance is denoted by dark green cells). The overall compliance with Table CRFR-A varies between 22% and 63%) as highlighted in Figure 3 below.

Figure 3: Heatmap of compliance by Asian banks with qualitative disclosures (Table CRFR-A on Governance, Strategy and Risk Management) of Basel CRFR Disclosure Requirements

Fourth, the Asian banks in the sample are still at a very nascent stage in qualitative and quantitative disclosures of risk metrics relating to Transition risk, Physical risk and Concentration risk.

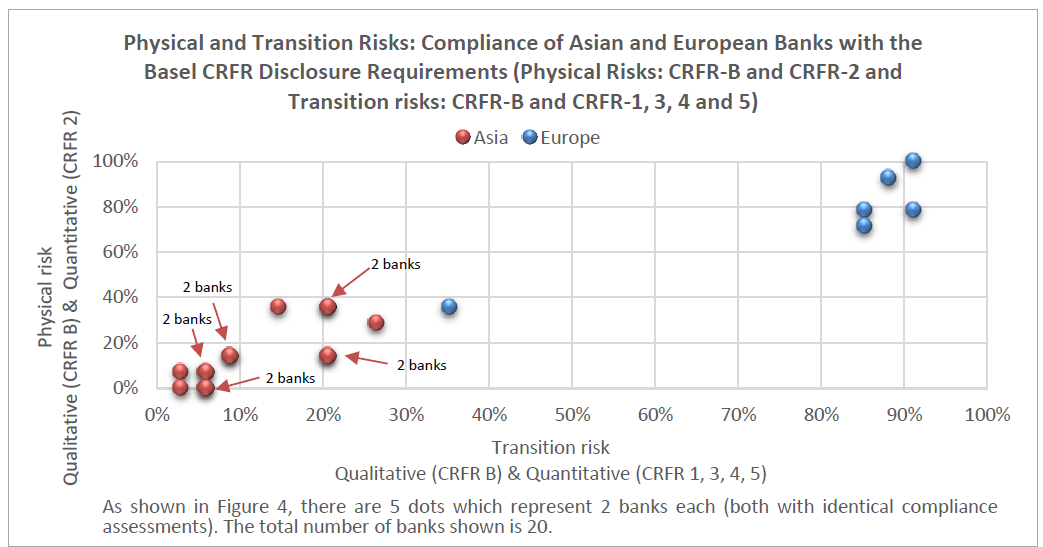

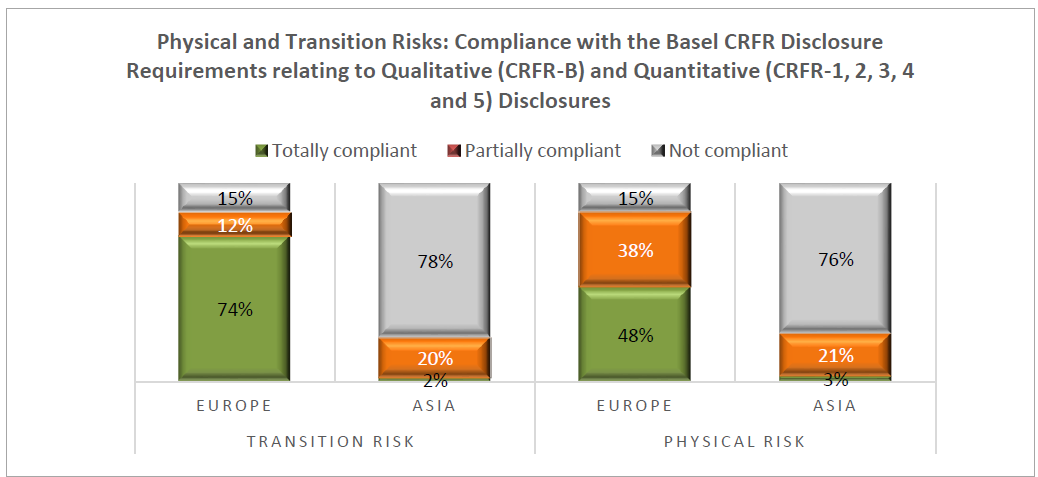

The Asian banks in the sample are only 12% and 13% compliant with quantitative disclosure requirements relating to transition risk and physical risk respectively. They are not compliant with 78% of the quantitative disclosure requirements for transition risks and 76% for physical risks. As shown in Figure 4, the European banks are at a much higher level of compliance: 74% are totally compliant for transition risks disclosures and 48% are totally compliant for physical risks disclosures. The qualitative disclosures for the concentration risk metric are made neither by European nor Asian banks in the sample, possibly because this is a new disclosure metric prescribed by the Basel Committee.

Figure 4: Compliance with Basel Disclosure Requirements relating to physical and transition risks

As shown in Figure 5, most of the Asian banks in the sample are not making adequate disclosures relating to the physical and transition risks (a dark green cell denotes full compliance and a pink cell denotes non-compliance with the disclosure requirements). None of the surveyed banks (both in Europe and Asia) made any qualitative disclosure relating to concentration risk.

Figure 5: Heatmap of compliance with Basel Disclosure Requirements relating to physical, transition and concentration risks (qualitative information – CRFR-B and quantitative information – CRFR-1 to 5)

1CRFR-B & CRFR-1 to 5

Fifth, it is noteworthy that few Asian banks in the sample are already well advanced in their qualitative disclosures relating to governance, strategy and risk management for climate-related financial risks (Figure 6). In addition, for the Asian banks in the sample, there is no correlation between the content and quality of Basel CRFR disclosures and the size of the bank (whether the bank is a G-SIB or not). The content, coverage and quality of banks’ disclosures of climate-related financial risks possibly depend on the bank management’s approach and commitment to climate-related financial risk disclosures.

Figure 6: Asian and European banks in the sample – compliance with Basel qualitative CRFR Disclosure Requirements – (Table CRFR-A and CRFR-B)

and

Asian banks in the sample (split between G-SIB and non-GSIB) – compliance with Basel qualitative CRFR Disclosure Requirements – (Table CRFR-A and CRFR-B)

Conclusions

The desktop survey reveals that even without mandatory regulation for disclosure of climate-related financial risks, the Asian banks in sample are complying with some elements of the Basel CRFR Disclosure Requirements. More work, however, needs to be undertaken for full compliance. The implementation of the Basel regulation will incentivise the banks to develop adequate frameworks for the management of climate-related financial risks and ensure compliance with the disclosure requirements.

Some of the best disclosure practices in terms of governance, strategy and risk management of climate-related financial risks observed in the surveyed banks are listed below.

Qualitative disclosures – governance:

- Disclosure of skills matrix of the board members regarding climate-related financial risks.

- Details of training sessions held for the board members together with the dates on which these were held.

- Disclosure of the remuneration policies for the board members in a tabular form showing all the required details.

- Disclosure of clear and detailed organisational charts with the role of the committees addressing the climate-related financial risks.

Qualitative disclosures – strategy:

- A mapping between the results of the risk materiality assessment with both the risk strategy (through the risk appetite statement) and business strategy.

Qualitative disclosures – risk management:

- Disclosures of the limitations encountered in the reporting of climate-related financial risks as well as the remediation measures taken by the bank demonstrates a transparent approach as the methodologies to identify, assess, prioritise and monitor the climate-related based are still evolving.

Qualitative disclosure of physical and transition risk metrics:

- The bank focuses on the disclosures of physical and transition risk metrics relevant to its business model and value chain. A general statement on the transition and physical risk drivers does not add value.

[1] The desktop survey is based on a review of all the publicly available documents of banks on their website in English. The disclosures made for the year 2023 have been considered for assessment in the survey if there is no later information available.

[2] An Implementing Technical Standard (ITS) on prudential disclosures of ESG risks has been issued by the European Banking Authority.

[3] Based on Figure 2, the overall compliance assessment with the strategy component has been shown as 31% (due to rounding-off errors).